Reward programs are based on hard sales data. This data is the “secret sauce” for calculating loyalty program ROI. The actual calculations are not at all difficult. You simply need to ensure you have the right sales data and the rest is relatively easy.

Four key customer data metrics needed to calculate loyalty program ROI accurately

1. Pre-program sales data

First, collect 12 months of historical sales data. This is your “before” and serves as your benchmark against which to understand how reward earning customers or sales reps change their behavior. This data should include all existing customers (active and any lapsed accounts) who spent anything with you in the year prior to launching your program. Break down the data against crucial metrics such as average order value, purchase frequency, total 12 month spend, etc.

2. Post-launch sales data

Collect at least 6 months of sales data post-launch. It’s important that you don’t try to measure your program after 1 or 2 months. You need to let key stakeholders become familiar with the program before trying to measure the program's impact. Customers need to be aware of the program, sign up, start receiving targeted offers tied to their purchase history, and start changing their purchasing behavior, directing more purchasing to you and away from the competition.

Similarly, your sales team and channel sales partners need to learn how to use the reward program to drive customer engagement, stimulating the repeat or new purchasing and incremental sales the program is designed to deliver. That won’t happen overnight, so build in at least two quarters of “soft launch” time to allow for this.

It’s also important, when looking at post launch data, to use non-reward customers (eligible for the program, but who DO NOT sign up) as an important control group. They are subject to the same market influences as reward earners. They help to eliminate uncertainty in your ROI calculations due to sales impacts like economic down-turns, severe weather, tariffs or price increases, supply chain issues, etc.

3. Program costs

A loyalty program’s costs are more than just the fees for the rewards earned by the program participants. A good loyalty platform will include program costs for a self-service website where reward earners can check program offers, point balances and redeem their loyalty points for rewards. The program should also include a regular (monthly or bi-weekly) reward statement with personalized account balance, bonus offers and a link to the redemption interface. These start-up costs need to be factored into the ROI analysis as do program administration fees and staffing costs.

For startup costs, you can either include the entire amount (assuming they are one-time costs) in your Year 1 ROI analysis, but given most reward programs are multi-year sales programs, it is more practical to amortize these costs over the first 3 years of the program’s existence instead.

Ongoing internal staffing or program administration fees (from a vendor) should be included in each individual year’s ROI analysis.

4. Gross profit data

You will also need the gross profit data for the target audience(s) you invite to participate in your program. Gross profit can change dramatically between customer types and many programs will limit who can participate in the program.

You need to compare apples to apples.

Program ROI can vary dramatically between the different target audiences involved. Consider a rolled-up ROI analysis with all customers, as well as ROIs for each main group.

Top 5 considerations when calculating your loyalty program ROI

1. Have faith in the ROI Formula

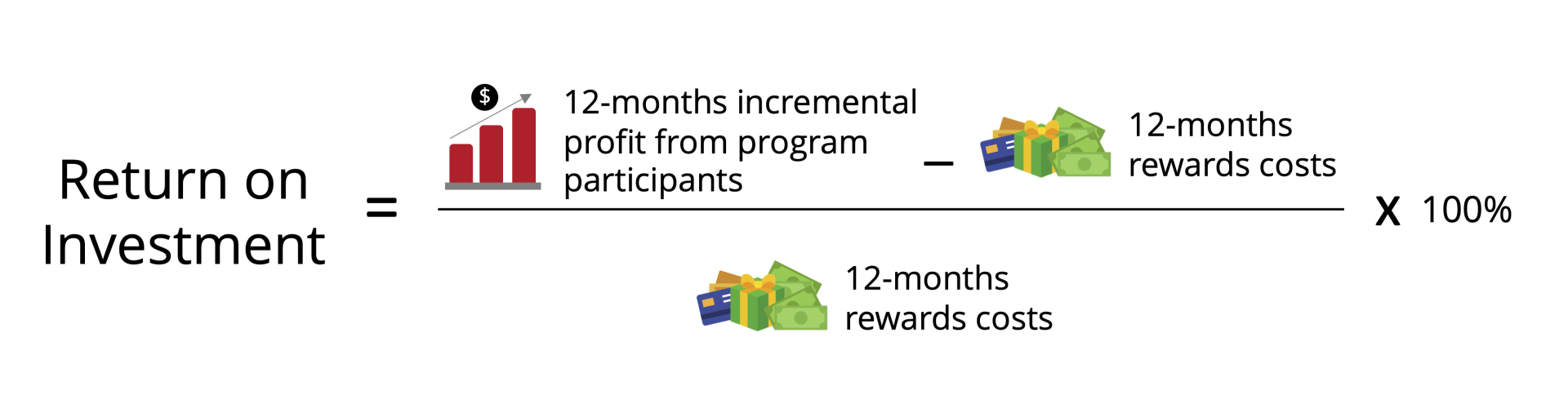

In its simplest form, the program ROI is calculated using the incremental Gross Profit of the reward customers and the reward program costs tied to these same customers:

The biggest mistake many people make when calculating the ROI of loyalty programs is to undermine the program’s influence on your brand(s), assuming loyalty program participants “would have made these purchases or sales anyway” and to not give the program impact its due. Keep in mind a reward program is an “opt-in” program, where the customers or sales reps who sign up are telling you they like rewards and wish to participate. This is where the non-reward earner data comes into play as a control group.

Let’s assume a company has 1,000 customer accounts. So long as each group’s

sample size is over 88 (reward earners and non-reward earners), you can be 95% confident that the difference in purchasing/sales behavior between these two groups can be attributed to the key difference (rewards vs. no rewards) between the two groups – assuming there is no other significant variable.

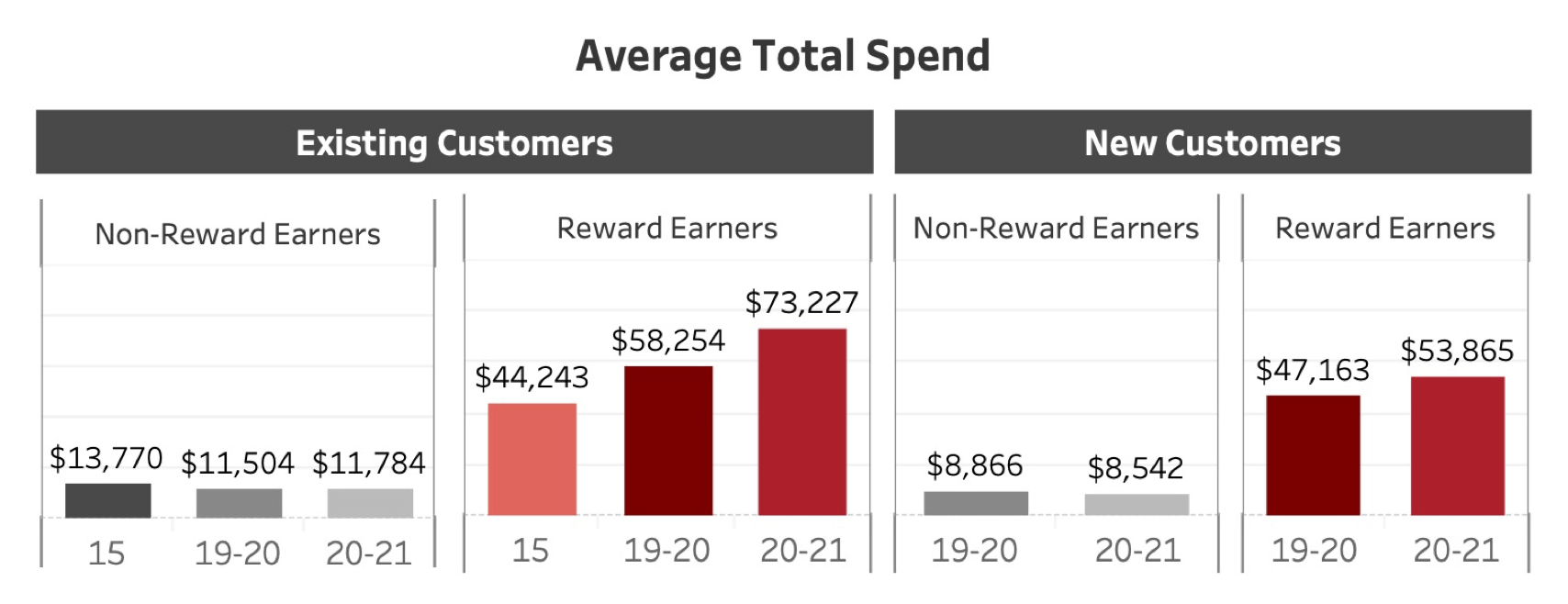

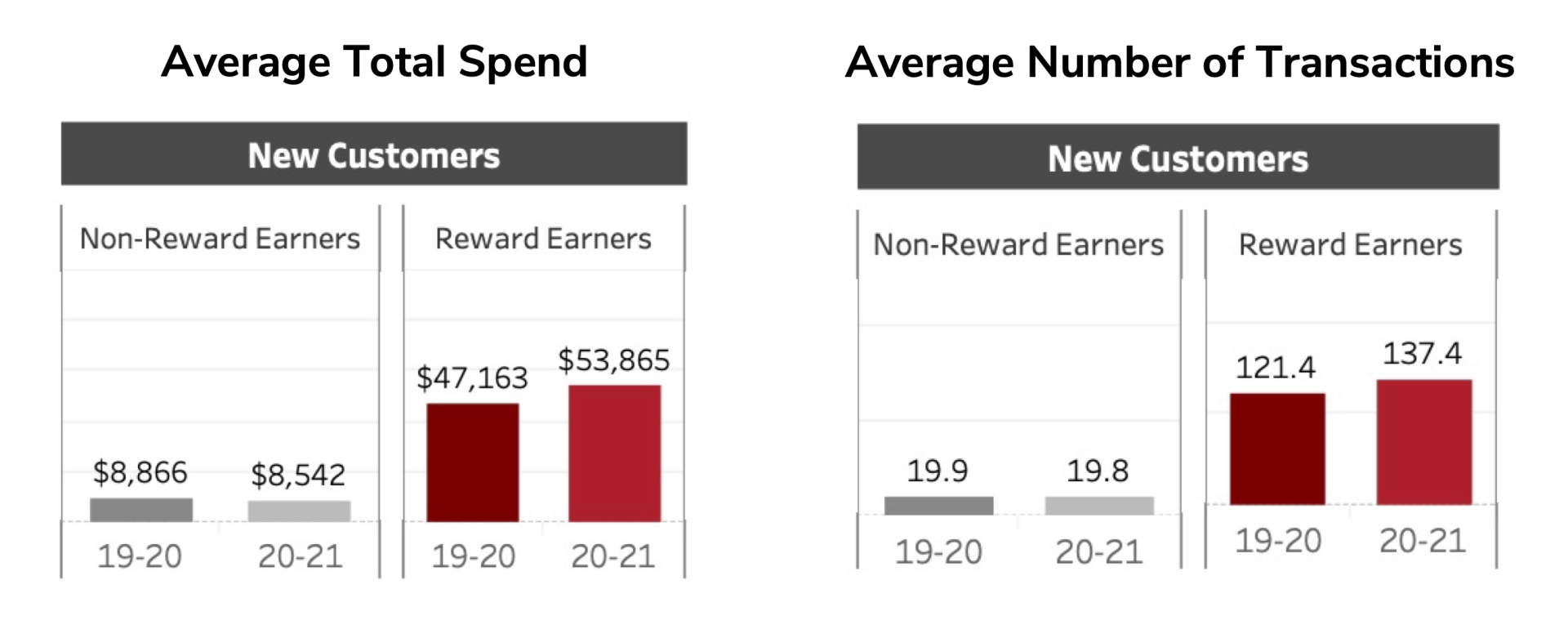

Using non-reward earner data to validate reward earner data. Source: Lift & Shift client data

2. Segment your findings

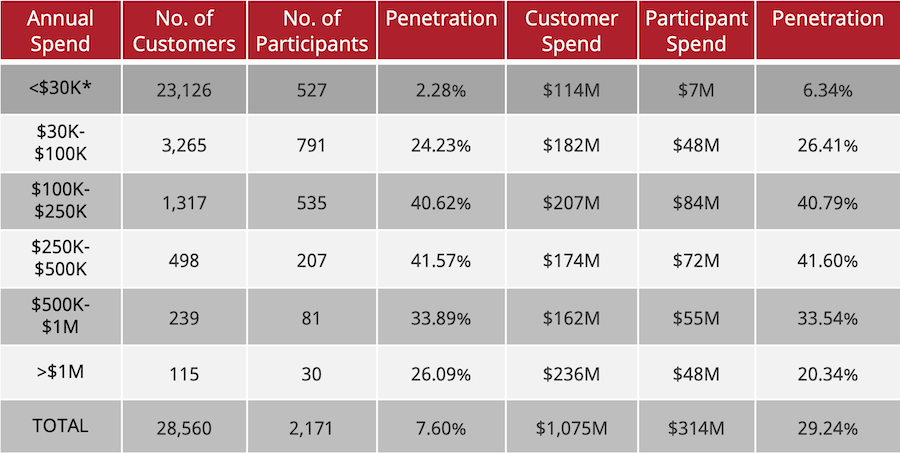

Look at the results by account group segments and types. Consider using revenue levels in order to compare program impact on small, medium and large sized customers as not all customers will respond to the reward program in the same way.

Sample: Participant Base - Participant Penetration by Annual Spend

Large accounts may employ buyers who are not allowed to participate in a program, or these accounts may already enjoy other perks (different pricing levels, free shipping, etc.) that already impact your bottom line and gross profit. You may not want them to double dip and enjoy even more benefits, like your reward program. Many programs may also require minimum spend levels to gain access to the program; some programs will not be available to very large accounts (national or government), etc.

It's also a good idea to segment and examine how new customers (new accounts since the program launched) are impacted by rewards. Most people use reward programs in their personal lives and are just as likely to do so in their professional lives, as business owners or purchase influencers. Not only will many customers elect to join their vendor’s program when they determine it is available to them, many will become new loyal customers BECAUSE of the program, especially if the program employs strategic acquisition bonus offers, designed to attract new account openings (with some sort of minimum order requirement).

Examining impact of rewards on new customers. Source: Lift & Shift client data

3. Calculate ongoing program ROI – AND short-term tactical campaign offer ROI

A program will have ongoing “maintenance” offers, driving customer key objectives such as Year Over Year revenue growth, customer lifetime value, customer satisfaction and retention, brand loyalty, reducing churn and maintaining your share of market. But all good programs should also employ short term tactical offers tied to short term sales objectives (new product launch, average order value, repeat purchases, multi-unit purchases, vendor offers, in-house brand offers, monthly or quarterly minimum spend targets, etc.). The impact of these offers will be included in the larger picture but be sure to measure the ROI of these short term offers individually as well to ensure each one delivers its own acceptable ROI.

4. Consider the long-term value of key strategic sales objective achievements as part of your calculations

5. Use your ROI analysis to fine-tune your reward program over time

Lift & Shift offers a powerful proprietary B2B reward platform that can help your company leverage its sales data to drive incremental purchases with customers and channel partners or motivate sales staff. We work with manufacturers, distributors, and service providers to analyze sales data, identifying purchasing gaps and other valuable targeting opportunities.

We create and deliver highly relevant offers to customers, in-house sales staff, or sales associates, motivating your target audience to respond, using a wide array of appealing reward options as influencers. Our performance-based reward structures deliver an unparalleled return on investment, with absolutely no wasted budget.

Our customizable reward platform enables clients to easily benefit from a robust loyalty reward program. It's affordable and includes Lift & Shift’s turnkey professional program administration. We take care of everything, so you can focus on your key initiatives.